December 3, Manila – 2025 unfolded amid global volatility and local controversies, yet the Philippine real estate sector continues to surface compelling silver linings. According to global real estate services firm Santos Knight Frank, strengthened policy reforms are poised to bolster investor confidence, Manila is emerging as a competitive hub for AI-driven enterprises, and the evolving REIT framework is widening asset classes—signaling a market preparing for sustained resilience and long-term growth.

Rick Santos, Chairman & CEO of Santos Knight Frank says: “Looking at 2025, it’s clear that this has been a year marked by purposeful pivots and structural shifts across the Philippine real estate landscape. The signing of the 99-year land lease into law, along with progressive amendments to the REIT framework, signals a strong policy environment—one that broadens the universe of acceptable assets and unlocks new channels for long-term investment.”

He adds: “We’re seeing growth decentralize, with major developments rising in Cebu, Pampanga, Davao and New Clark City—signaling a more diverse economic trajectory. Across sectors, the market is recalibrating: office supply continues to expand, hospitality is enjoying one of its strongest cycles, retail is moderating, and residential pressures are opening attractive opportunities in the secondary market.”

Santos concludes: “Through these shifts, the Philippines remains a market defined by resilience, reinvention, and untapped potential. And even amid calibration, 2025 presents clear silver linings—opening new pathways for renewed confidence and long-term, sustainable growth.”

99-Year Land Lease Strengthens Investor Confidence in the Philippines

The signing of the 99-year land lease marks a pivotal step in strengthening the Philippines’ investment landscape. By offering long-term security of tenure, the policy enhances the bankability of major developments, increases the country’s competitiveness for foreign capital, and unlocks opportunities for large-scale, long-gestation projects.

It encourages deeper partnerships between local landowners and foreign investors, supports the growth of REITs, and boosts overall confidence, liquidity, and productivity across the real estate sector. The measure also aligns the Philippines with ASEAN peers that already offer extended lease terms, positioning the country more competitively for foreign direct investment.

With long-term lease security in place, demand for land in strategic locations is poised to rise – driving land values upward, accelerating new developments, and reinforcing a positive trajectory for the Philippine real estate market in the years ahead.

IT-BPM Expansions Drive Office Market Growth in 2025

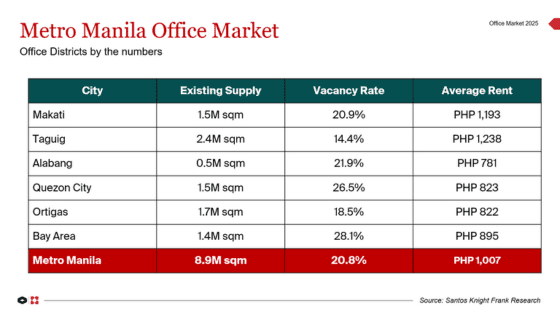

YTD net absorption this 2025 records at 461,245 sq.m., largely driven by expansions from the IT-BPM industry. Metro Manila’s office stock now totals 8.9 million sq.m., with an additional 328,000 sq.m. delivered as of November 2025.

Metro Manila’s office pipeline remains robust, with over 1.5 million sq.m. scheduled for completion through 2029—primarily in Quezon City, Taguig, and Ortigas—though moderated timelines are expected as developers adjust to tempered demand.

Metro Manila maintains a 21% vacancy rate as of November, while Taguig continues to command the highest average asking rate at PHP1,242/sq.m./mo., 23% higher than the overall average of PHP1,007/sq.m./mo., followed by Makati at PHP1,193/sq.m./month asking rate.

Residential: Shift to Regional and Premium

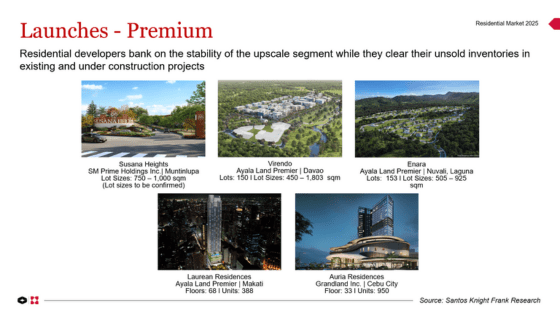

Developers are increasingly positioning new projects just outside Metro Manila as buyers seek more space, improved livability, and more accessible price points. This shift is driving activity in nearby growth corridors, where developers are rolling out not only horizontal communities but also mid-rise residential formats to meet evolving demand.

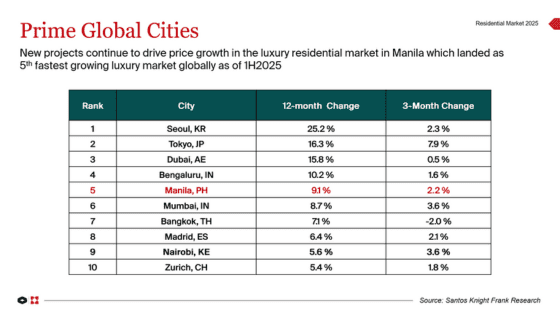

At the same time, Metro Manila’s pipeline continues to be defined by premium and high-end developments, including Ayala Land Inc.’s Laurean Residences and Megaworld’s Uptown Modern, both with target completion for 2030. Manila retains its place in the global luxury landscape, ranking 5th in Knight Frank’s Prime Global Cities Index, supported by a 9.1% y-o-y increase in prices—further underscoring the city’s status as an affordable yet fast-appreciating luxury market.

Hospitality Outlook: Strong Hotel Pipeline and Tourism Recovery

The hospitality sector posted a robust performance in 2025, marked by a series of high-profile hotel launches from major international operators such as Accor, Marriott, and Banyan Tree—each strategically located to capture both domestic and international demand. Tourist arrivals reached 4 million, supported by government-led initiatives including the VAT refund program and expanded visa-free entry, reinforcing the Philippines’ attractiveness as a regional destination.

The outlook for the sector remains highly optimistic, with a solid pipeline set to elevate the country’s hospitality landscape even further. Upcoming openings include Canopy by Hilton, the completion of Sofitel by Q4, Mövenpick Manila Bay, and the Mandarin Oriental, all of which are expected to enhance the country’s luxury and upscale offerings.

Moreover, investment in MICE infrastructure continues to gain momentum, with major facilities such as SMX Seaside Cebu, Mactan Expo Center, and the Bohol International Convention Center, positioning the Philippines as a more competitive player in the regional meetings and events space.

Industrial Outlook: Data Center and Specialized Facilities

Evolving industrial demand has bolstered the industrial sector into a new direction, shifting from the traditional dry warehouse to specialized industrial facilities such as data centers, cold storages, and smart manufacturing storage warehouse.

The data center industry is optimistic as more players continue to locate in the country. The Department of Information and Communications Technology notes that the Philippines’ data center capacity could reach 1.5 gigawatts (GW) by 2028 as more operators, both local and foreign, continue to set up facilities in the country in the coming years. Cloud services and digital transformation are driving the demand for this industry.

Similarly, more industrial parks/estates are being launched in the country. CALABARZON and Central Luzon remain the hotspot for this industry with its proximity to ports and the metro.

Retail Growth: Provincial Malls and Global Brand Expansion

Similar to the residential sector, the retail landscape is experiencing a wave of new mall completions in key provincial locations, with major developers introducing formats that mirror the scale and quality of Metro Manila’s premier retail destinations. Optimism remains strong, particularly in northern Luzon and southern Mindanao, where sustained consumer growth is driving continued expansion.

2025 also marked a steady rise in global brand activity, supported by government initiates that streamline the ease of doing business. We saw more global brands proliferate our retail sector – from lifestyle fashion labels such as Maje, Alice + Olivia, and Sandro; to hobby and sports names like Alo, Oysho, and Wilson; to high-end F&B concepts including Smith & Wollensky, Niku Niko Oh!! Kome, and Dave & Buster’s.

With strong consumer demand and an increasingly business-friendly environment, we anticipate even more global brands making their mark in the Philippines—further elevating the country’s retail landscape and bringing world-class experiences closer to more Filipinos.

- Tags: