Metro Manila’s office market performed significantly better than in previous quarters, as a result of mitigated covid spread, improving mobility, and return-to-office policies. The Metro Manila office market was in a bright spot in the latter half of 2022, as it was buoyed by both global and local market factors.

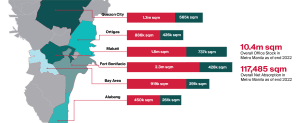

Metro Manila’s overall office supply has grown to almost 10.4M sqm, driven by the completion of buildings such as: Filinvest Land Inc’s 387 Building, Federal Land’s iMet BPO3, and Robinsons Land Corp’s GBF Center, which have introduced an additional 91,324 sqm to the market. The addition of new supply, coupled with office “right-sizing” of occupiers from both the corporate and IT-BPM sectors heeding the calls for continued work-from-home, have resulted in a total of 2,746,314 sqm of vacant space in the latter half of 2022.

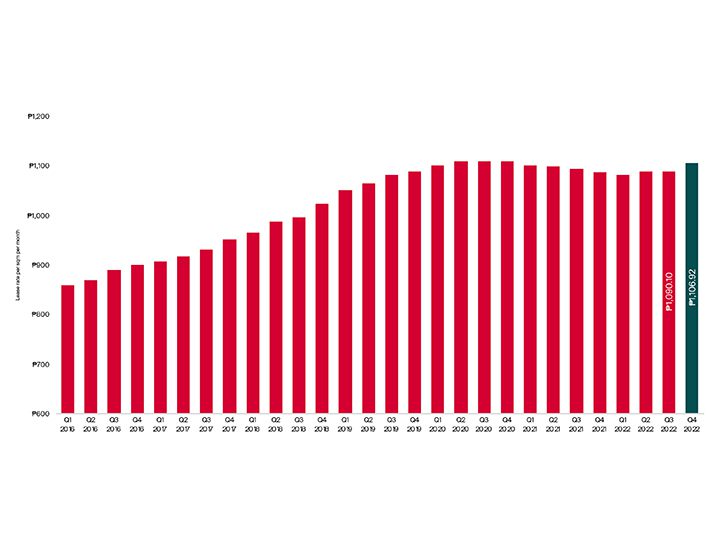

Rental correction was still evident in Metro Manila‘s office market as lease rents continued to fluctuate despite positive market performance during the last half of 2022. Lease rates have subtly increased by 2% from Q3 2022 to an average of Php 1,106/sqm. Landlords remained optimistic of the market and were more than willing to give considerable concessions to retain existing tenants and acquire new occupiers.

Makati

Office supply in Makati plateaued in Q4 2022 as no new buildings were completed during the quarter. The occupancy rate in Makati was recorded at 71% during the last quarter of 2022. Makati remains to have the highest average asking rental rate at Php1,275/sqm. This top rate is driven by Makati’s prime location and positioning as the country’s first Central Business District. Approximately, a total of 242,660 sqm of office space will be operational within the next three years, in the Makati office market.

Fort Bonifacio

The Fort Bonifacio market performed significantly better during the last quarter of 2022, compared to Q3. Occupancy in Fort Bonifacio’s market remained the highest among all CBDs in Metro Manila at 83%. The completion of the International Finance Center and Park Triangle Corporate Center has contributed to the growth of Fort Bonifacio office market.

The introduction of new supply in the market has increased total office space to almost 2,767,438 sqm of office space, resulting to a vacancy rate of almost 17% in the last quarter of 2022. Moreover, confident business outlook resulted to market improvement in demand with a recorded space take up of 2,304,683 sqm. Consequently, an approximate of 813,00 sqm is lined up to be completed in the next three years in Taguig, the majority of which is in Arca South; one of Metro Manila’s emerging business districts.

Bay Area

The egress of POGOs in the Bay Area coupled with the injection of more than 210,000 sqm of office spaces in the last half of 2022 have resulted in a consistently challenged office market. Despite this, the Bay Area fared significantly better during the last quarter of 2022 with a total of nearly 920,000 sqm of occupied office space. Lease rates remain pressured, averaging at Php 1,025 per sqm. An estimated 250,000 sqm is expected to be operational in the Bay Area for the next 3 years.