The residential market has seen mixed results during the pandemic. While there was a slowdown in sales in the vertical housing market, interest for single detached homes and residential properties outside the city increased as a result of density concerns and travel restrictions. With the pandemic almost over, Metro Manila is now seeing the return of demand for condos – and the resurgence of leasing especially in central business districts, such as BGC. OFW Remittances increased to almost 5.8% year-on-year, to almost $2.93 billion in November 2022. The depreciation of Philippine peso, against the greenback benefitted the residential market, as it made it more affordable to families receiving dollar remittances.

Supply

As the market recovery steadily progressed, the activity in the residential market in Metro Manila registered growth with the addition of 1,225 new residential units in Q3 2022.

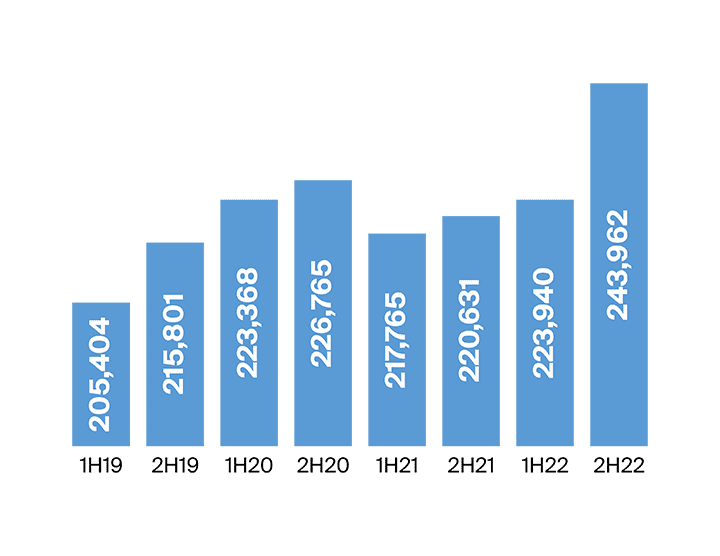

Condominium launches in the second half quarter of 2022 introduced an additional 2,000 residential units from Le Pont Residences from RLC Residences, Sage Residences and Fortis Residences from DMCI Homes, and Two Premier from the City Land group. These residential launches held during the second half of 2022 shows evidence of an improving business confidence from the supply side of the residential real estate, pushing the Metro Manila residential units supply to almost 326,000 units.

These recently launched projects are predominantly situated along the fringes of Metro Manila. Shifting preferences of developers from CBDs to the fringes is mainly driven by rising land cost and dwindling supply of developable land in the key areas of Metro Manila. Consequently, recent completions and upcoming improvements in infrastructure development and mass transportation have made these new residential developments more attractive to buyers.

Demand

Overall demand for residential condominiums in Metro Manila posted 48% growth against the first half of 2022, with a recorded 2,500 taken-up units in the last half of 2022. Most of the absorbed units in the last half of 2022 were from Taguig, Alabang,

and Quezon City. On a half-yearly basis, demand in the Bay Area remained stagnant following its decline in the first half of 2022. Residential demand in the Bay Area was pulled down by the POGO exodus implemented by the Philippine government against POGO operators.

Residential take-up in Makati increased by 24% in the last half of 2022, resulting in almost 228 absorbed units in the second-half of 2022. Moreover, Quezon City and Ortigas posted the most resilient performance as it recorded the highest sales velocity in the last half of 2022.

Projects positioned in both the affordable and high-end segments cushioned the slow-down of the residential market. Projects in these segments showed the highest absorption rate among all segments with almost 92%, and 93%, respectively. The favorable market absorption of the affordable price segment was mostly driven by adaptable payment terms, and affordable payment schemes offered by developers. Meanwhile, projects classified under the luxury segment recorded a slower market absorption, driven by the diminishing supply from this segment.

Selling Prices

Prices of condominiums showed significant growth in the second half of 2022. The average selling price of condominium development in Metro Manila grew by 10% year-on-year. The increase of condominium prices in Metro Manila was mainly driven by developers’ buoyant confidence of market absorption, combined with progressing economic activities.

Makati remains to be the biggest market, commanding the highest average selling price among other CBDs during the last-half of 2022 at 14% year-on-year amounting to an average selling price of Php 303,392 per sqm. The increase in the selling price of residential developments in Makati was mostly driven by the price appreciation of projects located in the CBDs which have grown by 11% year-on-year to an average selling price of Php 318,114 per sqm. Moreover, projects in the fringes grew by 14% year-on-year to an average selling price of 300,000 per sqm.

Meanwhile, Ortigas and Quezon City have registered substantial growth during the last half of 2022. Quezon City saw a growth of 32% year-on-year, equating to an average selling price of Php 190,629. Price appreciation in Quezon City was mainly driven by the significant improvement of residential sales velocity in the market, mostly buoyed and driven by the introduction of new projects in the market.