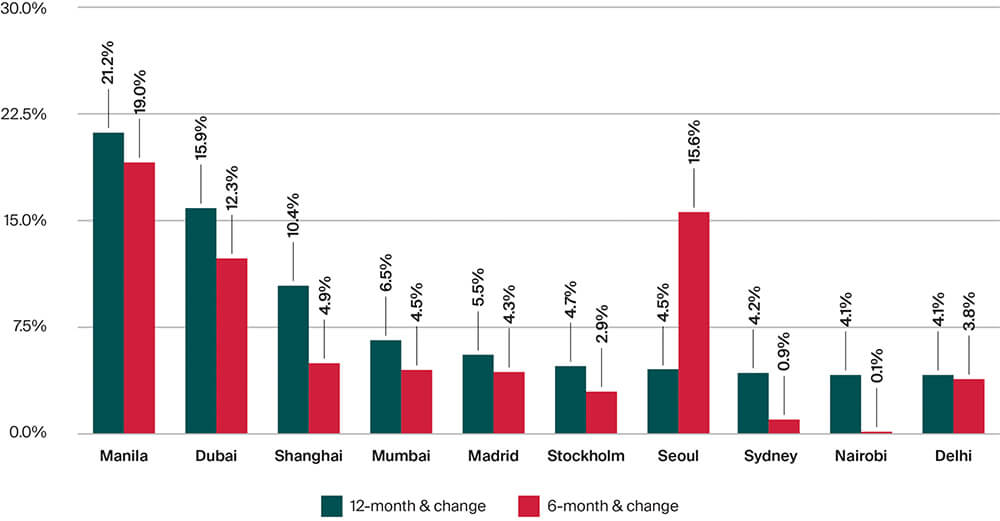

Manila led global prime residential growth at 21.2% year-on-year in Q3 2023.

Over the recent years, the Philippines has witnessed significant growth in local wealth creation, leading to the rapid expansion of investable properties in luxury residential developments, including the emerging sector of branded residences.

In Q3 2023, Manila’s prime residential prices grew by 21.2% — the fastest across the world according to Knight Frank’s Prime Global Cities Index. The recorded price appreciation of the most expensive developments in the country demonstrated a consistent upward trend even during the pandemic, serving as a mitigating factor against the adverse effects on the Philippine residential market. This resilience in price appreciation signifies the enduring allure and desirability of luxury properties, contributing to their ability to withstand economic challenges and sustain market attractiveness for affluent buyers.

Demand-pull dynamics

One potential explanation for the observed price trend suggests that pricing is increasingly being shaped by demand-pull dynamics.

This phenomenon has become particularly pronounced in the post-pandemic period, during which luxury residential properties have enjoyed a surge in popularity, resulting in significant appreciation in their market value. At the height of the COVID-19 pandemic, the Bangko Sentral ng Pilipinas (BSP) reported a remarkable 27% year-on-year increase in property prices nationwide. This surge, the most significant since 2016, can be largely attributed to the escalating demand for high-end real estate projects, as recognized by the BSP.

Real estate investors are generally confident with the resilience of luxury property segments, even within the global economic landscape characterized by rising interest and mortgage rates. This confidence stems from the understanding that real estate properties possess intrinsic potential to appreciate in value over time, a characteristic capable of mitigating the adverse effects of higher interest rates.

Another contributing factor to this trend is the fact that the population of high-net-worth individuals (HNWI, defined as having at least $1 million in net assets) is still growing – more specifically, UHNWIs (ultra high-net-worth individuals, at least $30 million in net assets). In 2021, the country recorded 489 individuals meeting the criteria for UHNWI. This significant local wealth creation has spurred the rapid expansion of investable luxury residential developments, particularly in the luxury market. Developers have proactively prepared for increased supply in anticipation of this surge in demand, further propelling the momentum in the luxury real estate sector.

Looking ahead, projections indicate that the UHNWI population in the Philippines is expected to experience growth. By the end of 2025, it is estimated that the count of UHNWI will reach approximately 658 individuals. In contrast, the HNWI category represents a larger cohort within the wealth spectrum. In 2021, the Philippines recorded a population of 13,936 HNWIs. This figure is projected to rise to approximately 18,989 individuals by end-2025, reflecting an expected growth in the number of affluent individuals in the country.

Lastly, investors, in general, have also been optimistic with the current administration of President Ferdinand R Marcos Jr., whose policies have been encouraging investment commitments to the Philippines. This image contributes to the fact that the Philippines’ prime residential properties are one that appeal to international buyers looking for competitive prices. One could buy a significantly larger luxury property in Manila than in other global cities.

The interplay of demand-pull and supply-push factors within the luxury real estate market underscores the complexity of economic forces at play, providing a perspective on growth potential of this market.

Metro Manila’s prime residential

Knight Frank APAC figures on annual price changes

Metro Manila luxury market price movement