What are some of the main drivers?

With the exception of Singapore, the data center market in Southeast Asia is still in its infancy. Many emerging economies within the region lack the minimum infrastructure required for the sector to function (e.g. stable power supply, extensive fibre broadband network etc.). Despite these challenges, the potential opportunities from establishing a healthy data centre industry within these economies far outweighs the risks. The region’s middle-class is forecast to expand rapidly which will not only accelerate e-commerce growth, but also drive a greater amount of data consumption and data generation.

Cybersecurity concerns are another driver of data center growth within Southeast Asia. Local and government-linked enterprises, which contribute a large proportion to local economies, will increasingly need data centre services. Due to national security concerns, governments across the region would prefer to see data stored and processed domestically rather than relying on major data centers outside their territory.

What could growth look like?

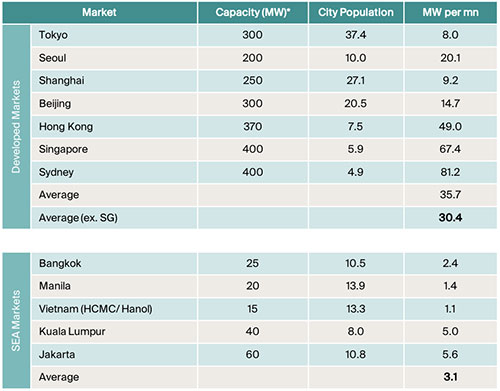

Analysis of the current capacity of Southeast Asian markets compared to the largest data centre markets within the Asia-Pacific region, underlines the potential for growth.

Source: Knight Frank Research

*estimates as at end-2019

From the table, the major Asia-Pacific data centre markets have a current capacity of 35.7 MW per million capita (taking into consideration only the city population) as at the end of 2019. If we were to exclude Singapore, which currently acts as the data center hub for Southeast Asia, the per capita rate falls to 30.4 MW per million. This is almost tenfold the current capacity per capita for the Southeast Asian markets which have on average only 3.1 MW per million capita.

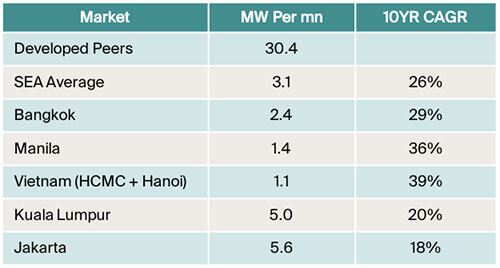

Source: Knight Frank Research

*estimates as at end-2019

Now if we assume that the Southeast Asian markets, at their current 3.1 MW per million capita average, play catch-up with their Asia-Pacific developed peers over a 10-year period, given that infrastructure will take some time to plan and construct, this equates to an annual CAGR of around 26%. Taking a closer look at the data, Manila and Vietnam (HCMC and Hanoi) stand out as two markets that are projected to be the fastest growing with 10-year CAGRs of 36% and 39% respectively. Furthermore, we must note that our growth estimates are on the conservative side as our calculations have yet to factor in population growth which will increase our CAGR calculations.

Next Steps?

Southeast Asia is expected to be a bright spot for data center growth within Asia-Pacific as the region’s data center industry (excluding Singapore) remains relatively undeveloped. But with its growing middle-class demographic and the subsequent boom in technology and data consumption, it will be a region that investors, occupiers, and solution providers find hard to ignore. Granted there are risks involved and an immature infrastructure environment is currently not able to support rapid growth, but this should change over the longer term as governments have acknowledged and are largely expected to steadily improve their technology infrastructure over the coming decade.