Read the third part of the report here.

C. Changes to Footprint in Current Location/s

With only 18 respondents indicating possible changes to footprint in current locations, 81% expect a considerable level of stability in terms of leased area in current locations.

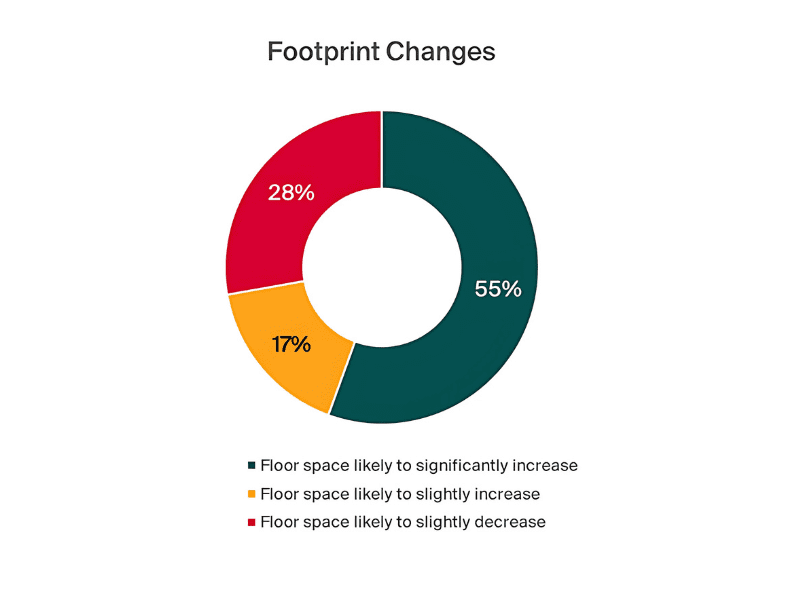

Among those who do expect footprint changes, 56% expect significant increase, while another 17% expect slight increase. Nobody chose the possibility for significant decrease, but 28% do expect some slight space contraction.

After more than 4 years into the onset of COVID-19, it is of our belief that most occupiers have already arrived at a comfortable footprint that their current operations require. Both expansions and contraction at this point are likely caused by operational changes.

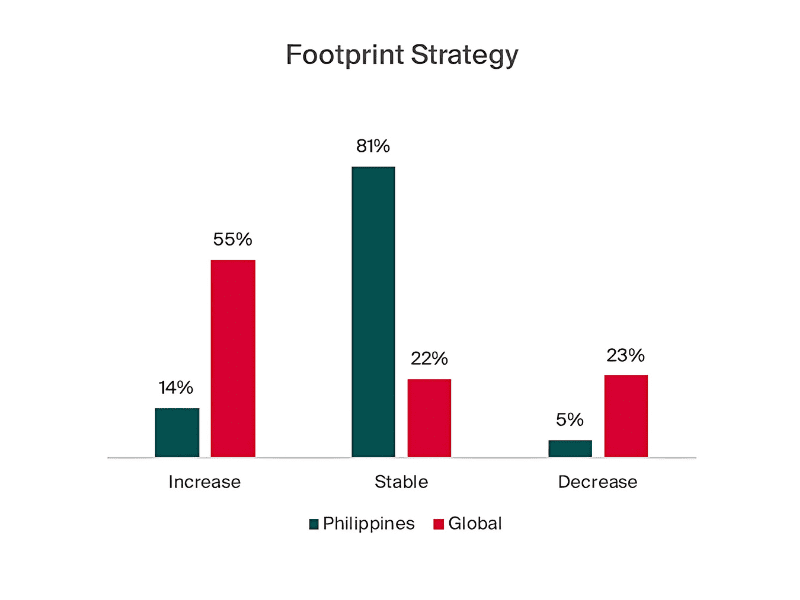

Comparing the results of the local occupier sentiment survey and the results of the 2023 (Y)Our Space Report by Knight Frank Cresa, a lot more of Philippine-based companies are expecting no changes in their footprint. And while globally, more companies are expecting growth within in their existing real estate portfolio, there are also less Philippine-based companies that are expecting to downsize.

D. Relocation

Relocation is a real estate strategy that a lot of occupiers practiced during the pandemic usually for one of two reasons: practical considerations due to the financial impact brought about by the pandemic, or the more celebrated flight to quality.

With most leases following a typical 5-year lease term, lease acquisitions that commenced in the last pre-pandemic year – 2019 – are expiring this year, opening an opportunity for relocation to either a cheaper or better building, or both. It must be highlighted that 2019 has the highest annual net absorption in Metro Manila’s office market history at 833,000 sq.m.

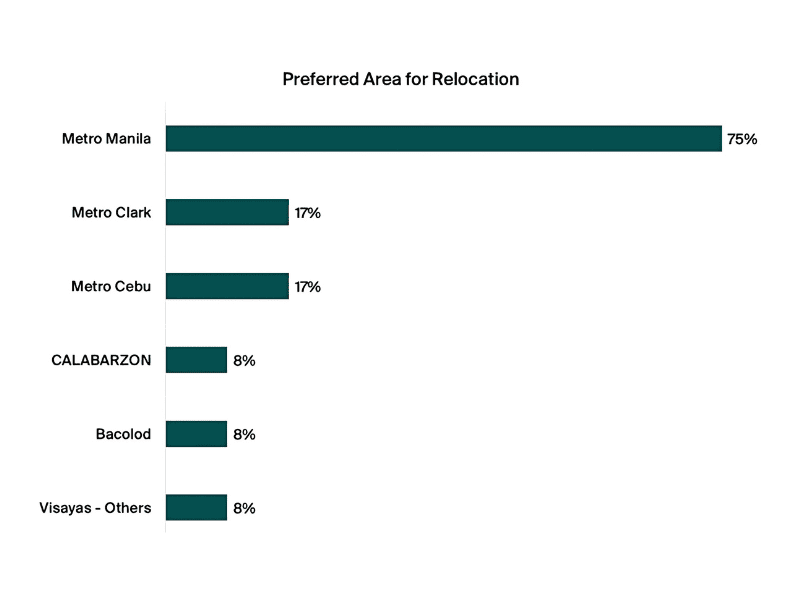

The results of our Occupier Sentiment Survey show that only 13% of respondents are considering to relocate. Of those that do, 75% want to relocate in Metro Manila – and all of them are either primarily based in Metro Manila, or at least have presence in Metro Manila already.

Other areas sought for relocation are Metro Clark, Metro Cebu, CALABARZON, Bacolod, and other parts of Visayas.

Among the respondents who are likely to relocate, 83% listed better accessibility for current employees as the top consideration for relocating. This resonates with the concept of hub-and-spoke model wherein smaller offices near employee residences are made available as an alternative to going to their main office. This also supports how a number of respondents have multiple locations with Metro Manila, and a good number also plan to expand within Metro Manila as well.

Lower occupancy cost emerged as the second biggest reason for relocating while better quality of building came as third. Better access to talent had the least share relative to the others perhaps indicating a not-so-aggressive outlook when it comes to hiring new talent for the meantime.

Flight-to-quality continues to be seen as a demand driver for higher-grade buildings, especially since the rental gap between older, less-efficient buildings and newer ones have been shrinking. Furthermore, negotiability in commercial terms continues to be generally wider as compared to pre-pandemic times, so occupiers can find that a lot of the recently-completed buildings can offer more cost-efficiency.

Relocation, as well as the other aforementioned general real estate strategies, are all geared to bring about a workplace that meets the demands of evolving workstyles. The COVID-19 pandemic has turbocharged workplace evolution and while there is no one-size-fits-all strategy, occupiers are adopting what best suits their particular requirements.

The Office of the Future

The COVID-19 pandemic has undoubtedly impacted workplace dynamics. The concept of remote work, while already existing in the past in the form telecommuting, served as the saving grace of businesses at a time of lockdowns and social distancing.

With the help of science, going back to the office became possible – but in a manner much different from before. Varying degrees of implementation of hybrid work setup defines the modern-day workplace, and this affects not only the physical presence of people in the office, but also how offices are designed. Occupiers try to strike the right balance in terms of location, footprint, and layout.

More than 4 and a half years after the first community quarantine was announced, occupiers likely understand by now what kind of office setup works for their particular needs. And as occupiers endeavor to attain a future-ready office, the adoption of sustainability is also no longer just an aspiration, but a course of action that more and more are trying to set foot into.

The office of the future is therefore a play on the definition of sustainable development: an office that meets the workplace needs of occupiers without compromising the ability of future occupiers in meeting their own workplace needs.

You have reached the end of the report. You can download your own digital copy at https://bit.ly/thecollabspecialreport.

- Tags: