Read the previous part of the report here.

A. Expansion

After the series of right-sizing initiatives at the height of the pandemic and the years that followed, sentiment towards expansion is now recovering. This is aligned with recorded improving occupancy levels in the Metro Manila office market wherein net absorption for the 1st half of 2024 is 125% more than the annual total for 2023.

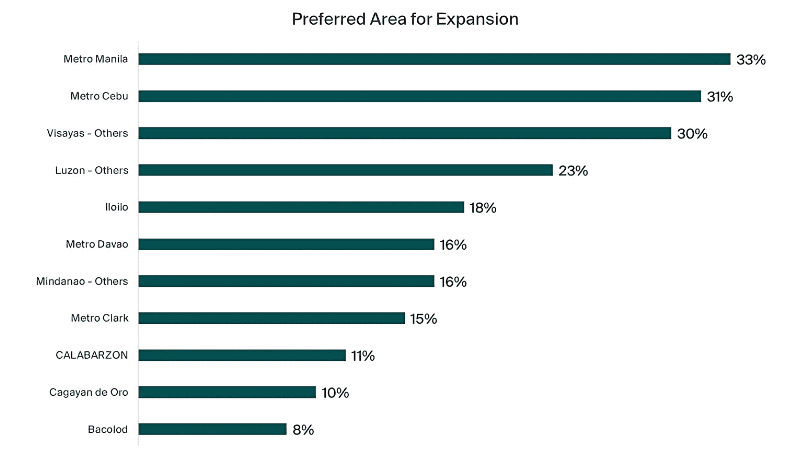

While a vast majority of respondents considering to expand come from companies that are already based in the National Capital Region, Metro Manila still commands the highest share in terms of where the respondents want to expand to at 33%.

Other locations that are part of the 5 most preferred areas of expansion are Metro Cebu (31%), other parts of Visayas (30%), other parts of Luzon (23%), and Iloilo (18%). [Note: percentages will not total 100% as respondents can choose more than 1 potential location for expansion.]

Aside from the traditional Mindanao options of Davao City (16%) and Cagayan de Oro (10%), there also seems to be an increasing interest in exploring other parts of Mindanao (16%).

“Luzon – others” refers to locations within the Luzon group of Islands other than Metro Manila, Metro Clark, and CALABARZON. Some emerging markets in Luzon are Baguio City; Dagupan City and Urdaneta City in Pangasinan; Malolos City and San Jose del Monte City in Bulacan; Naga City and Iriga City in Camarines Sur; Laoag City in Ilocos Norte; Tuguegarao City in Cagayan; Balanga City and Olongapo City in Zambales; Legazpi City in Albay; Puerto Princesa City in Palawan; Cabanatuan City in Nueva Ecija; San Fernando City in La Union; San Fernando City in Pampanga; and Tarlac City in Tarlac.

On the other hand, “Visayas – others” refers to locations within the Visayas group of islands other than Metro Cebu, Iloilo and Bacolod. Some emerging cities in Visayas are Dumaguete City in Negro Oriental; Tacloban City in Leyet, Tagbilaran City in Bohol; and Roxas City in Capiz.

Finally, “Mindanao – others” refers to locations within the Mindanao group of islands other than Metro Davao and Cagayan de Oro. Some emerging locations in Mindanao are Zamboanga City in Zamboanga del Sur; General Santos City in South Cotabato; and Iligan City in Lanao del Norte.

Countryside development is an agenda by both current and the immediate past administration, and a number of initiatives and programs were developed to support this. In 2019, then-president Rodrigo Duterte approved Administrative Order 18 series of 2019 which essentially placed a moratorium on the processing of applications of ecozones (under the Philippine Economic Zone Authority) within Metro Manila, shifting the focus to areas outside the National Capital Region.

In November 2023, current president Ferdinand Marcos, Jr. amended this with Administrative Order 11 series of 2023 which allows for the resumption of the processing and evaluation of applications for ecozones in Metro Manila in the condition that such applicants already received a pre-qualification clearance from the PEZA before the implementation of AO 18 s. 2019.

The Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, signed into law in 2021, also provides for longer tax holidays for enterprises registered under investment promotion agencies (IPA) if they are operating outside of Metro Manila.

IPAs such as the Board of Investments and PEZA have certain requirements in which eligible enterprises need to comply in order to qualify for incentives. For PEZA, in particular, the locator’s nature of business must be part of a list of eligible activities that are generally export-oriented, and they should operate within PEZA-registered locations or ecozones.

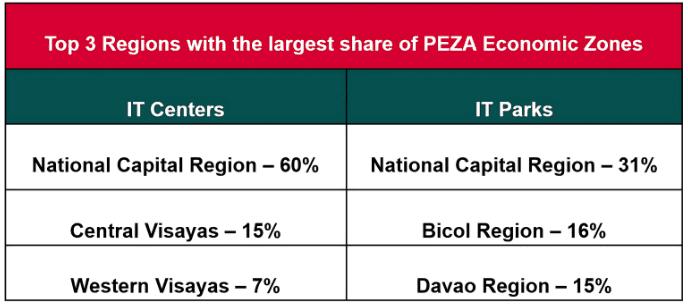

Of the 591 proclaimed economic zones, 41% are located in Metro Manila. Among proclaimed PEZA IT Centers and IT Parks, which IT-BPM companies prefer to locate not only in order to avail benefits, but also to ensure that they are in a building that can support their IT-intensive operations, Metro Manila has the highest share of 60% and 31% respectively. Central Visayas and Western Visayas have the 2nd and 3rd biggest share in IT Centers, while Bicol region and Davao region have the 2nd and 3rd biggest share in IT parks. These locations coincide with the top expansion options.

It seems that the preference for expansion prospects is more tied to where there are existing facilities that can support these occupiers’ operations as against compelling them to explore build-to-suit arrangements. The Government and private property developers must then work hand-in-hand in developing both infrastructure and office options in emerging markets in order to realize the ambitions of pushing development into these areas.

Read the next part of the report here.

- Tags: