Most companies eye office expansion in the next 3 years; Manila remains No. 1 location for expansion: Santos Knight Frank survey

- Metro Manila remains a preferred area for expansion at 33% based on SKF’s recent occupier sentiment survey.

- Prime villages in Metro Manila CAGR continues to increase at 17% from 13%.

- Manila ranks 3rd in warehouse rental across Asia Pacific with 9.1% YoY growth.

- More than 8,000 hotel keys will launch in the Philippines in 2025 driven by increasing tourist arrivals.

The office sector is expected to continue its rebound trajectory in 2025. Tenants are expressing optimism regarding their office expansion and right-sizing plans over the coming years. This insight comes from global real estate services company Santos Knight Frank.

Santos Knight Frank’s recent occupier sentiment survey, The Collab, revealed 64% of companies surveyed see potential expansion in their office footprint in the next 3-5 years. One in every three indicated choosing Metro Manila as their preferred location for growth.

Overall, the commercial real estate sector has been thriving in 2024, fueled by outsourcing expansion and leasing activity. Despite limited supply in high-end and prime real estate, the sector continues to show stability and growth amid evolving market challenges.

Rick Santos, Chairman & CEO of Santos Knight Frank says: “The Philippine real estate sector is riding on a wave of opportunities driven by proactive measures from the current administration to open the country further to investments. These efforts are creating a more dynamic and business-friendly environment, paving the way for sustained development and progress.”

“Momentum in the market remains strong, particularly in the residential segment, where Manila has once again secured the top spot in Knight Frank’s Prime Global Cities Index. Demand continues to drive price growth in this sector, fueled by limited supply,” Santos adds.

He continues: “At the same time, the preference for green-certified buildings is on the rise, signaling a shift among occupiers toward highly efficient, sustainable, and cost-saving grade-A buildings. This year, we saw a 5% increase in green-building take-up, equivalent to _ gross leasable area. The shift from traditional to green-certified spaces can also imply their real estate strategy in their flight to quality,”

“The Marcos administration’s CREATE MORE Act promotes investment-friendly policies designed to stimulate business growth and demand for real estate. With these reforms, Manila presents a prime opportunity for investors to capitalize on its expanding commercial and industrial sectors.”

Improving Occupancy in Metro Manila despite the POGO Ban

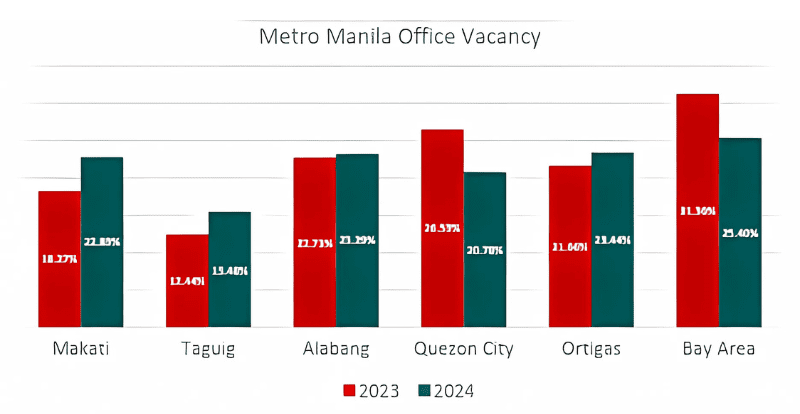

In November, the Philippine government issued an executive order to cease operations of Philippine Offshore Gaming Operators (POGOs). This decision is expected to raise office vacancy rates, particularly in POGO-heavy areas. The Bay Area, a hub for POGO-related office space, will likely be significantly impacted. However, the city has demonstrated resilience, with vacancy rates lowering down by 7.2%% compared to 2023.

Manila is still a preferred location for the BPO sector

Manila continues to assert its position as a leading destination for business process outsourcing (BPO) companies, ranking as the third most affordable city in Asia Pacific for occupancy costs, according to Knight Frank’s Q3 2024 Office Highlights report.

Among Metro Manila’s prominent CBD areas, Taguig remains the preferred office choice, with a vacancy rate of 12.4% lower by 2 basis points compared to 1H of 2024. Additionally, green-certified buildings continue to see strong demand, with an average take-up of 87.27% compared to 82.39% from traditional office spaces, most notably in Makati and BGC.

- Tags: