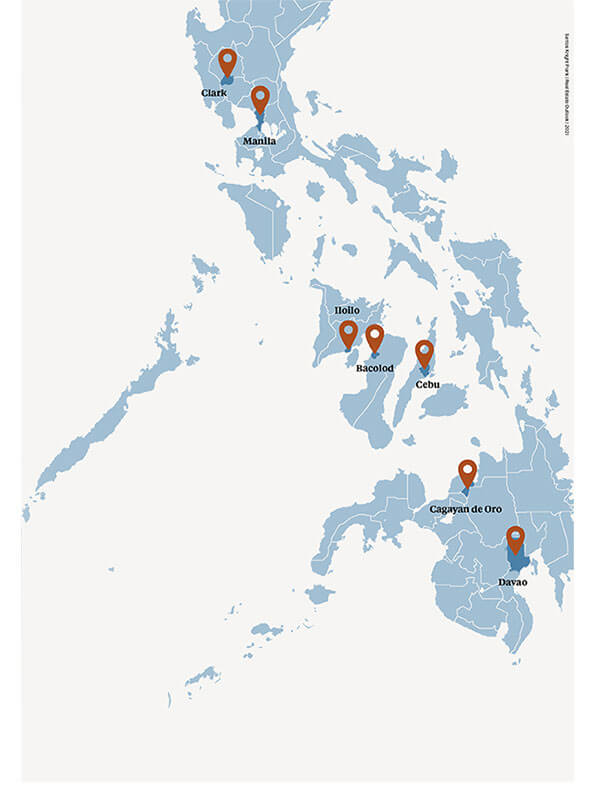

For the “Secondary Cities” of the Philippines, or those cities outside of the National Capital Region (NCR), the office market in 2021 should continue to look a lot like 2020: Generally soft, but with a few bright spots. Secondary cities will lose one big advantage this year-cost savings-as rents in the NCR continue to fall. But it does not have to be all doom and gloom in 2021, as the COVID-19 pandemic has created a new reason for companies to lease in secondary cities: Viral Diversification.

The BPO industry will be the dominant player in secondary cities, as always. Net leasing growth is estimated at 20,000 to 40,000 sqm in 2021. This growth will mostly come from third- party BPO companies, but a relatively new industry segment- healthcare BPOs-will play a significant role as well. The Fortune 500 BPOs have still largely stayed away from secondary cities, with the exception of Cebu, and that will likely continue to be the case in 2021.

Look for Iloilo to continue its reign as the darling of the secondary cities. Iloilo possesses the attributes that BPOs locators want: Grade A office space, a large hospitality labor pool, scalable city infrastructure, and a secure environment.

Metro Clark and Cebu have most of these attributes too, but they are established areas already. The next wave of cities includes Bacolod and Davao, both of which are being developed, but neither is expected to be on par with Iloilo One bright spot for secondary cities in 2021 could be companies’ need to geographically diversify for future pandemics. As seen during the COVID-19 pandemic, the Philippine government is willing to apply different treatments to different regions of the country, depending on the level of the pandemic in a given region. For companies, that could mean setting up a secondary office far outside of the NCR- most likely in secondary cities in order to maintain continuity of their operations in the event of another NCR lockdown. The Philippines has seen similar geographical diversification for the sake of typhoons, earthquakes, and volcanos, but now pandemics can be added to the list as well.

Clark

New infrastructure such as TPLEX and the new airport terminal will enhance accessibility in the region, contributing to the emerging opportunities in the area.

Manila

With office vacancy at 9.8%, the availability of more plug-and-play spaces and prime office space will be an opportunity for companies aiming for better locations.

Bacolod

One of the top real estate investment areas outside of Metro Manila. Developers continue to expand their foothold and see potential in the residential market.

Iloilo

The launch of the Batangas-Iloilo-Bacolod shipping route presents opportunities for trade and logistics sector. The residential property market is anticipated to see new supply as developers express intentions to expand

Cebu

Ease of restrictions for back-to-office movement provides recovery of small to large retail businesses. The hospitality sector remains optimistic for a gradual recovery in 2021 as domestic travel requirements ease.

Cagayan de Oro

The city is anticipated to see additional office supply coming from new commercial centers downtown and uptown areas.

Davao

New developments to roll out in 2021. Completion of Davao- Samal bridge to improve trade, logistics, connectivity, and market accessibility.